The Importance of Understanding Your Financials

Apr 24, 2024

Diving into the nitty-gritty of finances might not spark the same joy as transforming a space with your design magic. But, believe it or not, getting a grip on your financial numbers is just as vital to the success of your design or architecture business.

Now, I get it – when you're knee-deep in projects, juggling client expectations, and bringing those creative visions to life, the last thing on your mind is crunching numbers.

Yet, understanding the financial side is key to ensuring your business doesn't just survive but truly thrives. It's about making informed decisions that align with your creative passion and business goals. So, let's simplify things and explore why knowing your numbers is a non-negotiable part of your creative success story.

How Financials Apply to Your Business Growth

Imagine you're at the helm of a thriving interior design business. Eager to grow, you contemplate offering construction services to provide an end-to-end solution for your clients. Before making the leap, you delve into your financial numbers, a decision that enlightens your path in several key ways:

- Informed Decision Making: Your financial review reveals that while design services are profitable, construction requires significant upfront investment and longer project cycles. This insight helps you weigh the benefits against the risks, guiding your decision on whether to proceed with the expansion now or wait.

- Budget Management: By understanding your current financial health, you set a realistic budget for the expansion, ensuring you allocate funds wisely to avoid overextending your resources. You identify areas where your budget can be optimized, ensuring maximum efficiency.

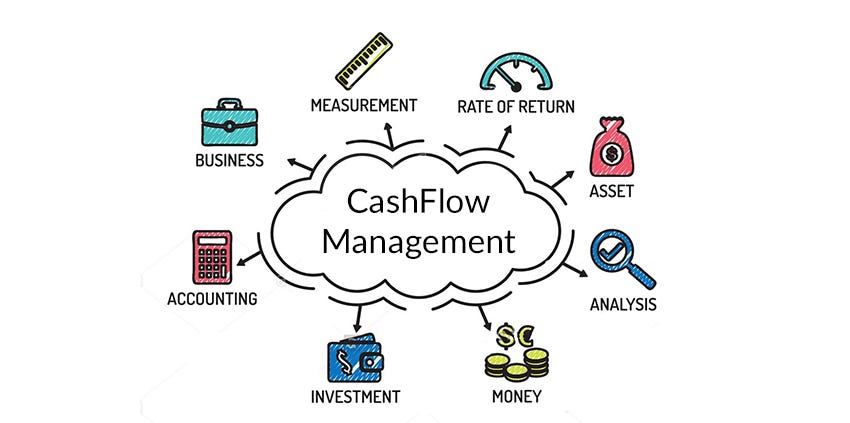

- Cash Flow Management: You calculate how expanding into construction will affect your cash flow, recognizing the need for a buffer to manage the longer payment cycles often seen in construction projects. This prepares you to maintain operations smoothly during the transition.

- Profitability Analysis: Reviewing your financials, you pinpoint which of your design services yield the highest profits and assess how incorporating construction could enhance or dilute these margins. This analysis helps you strategize on pricing and service offerings.

- Financial Planning and Forecasting: With solid financial data, you forecast the expected costs and revenues from the new construction services. This planning helps you set growth targets and timelines, ensuring the expansion aligns with your long-term business goals.

- Access to Financing: Armed with a clear understanding of your financial situation, you're better prepared to present your case to lenders or investors, securing the additional funds needed for the expansion with more favorable terms.

- Tax Compliance: You recognize how expanding into construction will change your tax obligations and prepare accordingly, ensuring you take advantage of relevant deductions and avoid any compliance issues.

- Risk Management: Understanding the financial stakes, you identify potential financial risks associated with expanding into construction, such as increased liability or cost overruns, and develop strategies to mitigate them.

- Performance Tracking: You establish financial metrics to monitor as your business enters the construction sector, enabling you to track your success against your forecasts and make timely adjustments.

- Stakeholder Confidence: By demonstrating a thorough understanding and strategic approach to your financials, you build confidence among your team, partners, and clients, reassuring them that the expansion is well-conceived and managed.

By integrating these financial considerations into your expansion plan, you not only navigate the complexities of growing your design business into construction but also position your enterprise for sustainable success and stability in both sectors.

5 Practical Tips for Managing Your Financials

Tackling the financial side of running a creative business can feel like navigating a maze, especially when your true passion lies in design and architecture, not numbers. However, mastering this aspect doesn’t have to be a daunting task. With the right strategies and tools, you can streamline your financial management, freeing up more time to focus on your creative projects.

Tip 1: Start by simplifying your tools. Choose user-friendly accounting software tailored for small businesses or solopreneurs. Look for one with a straightforward dashboard that allows you to easily track your income, expenses, and profits at a glance. This tool should save you time, not add complexity, enabling you to quickly get back to what you love. If you hire a bookkeeper and CPA, you will want to ensure the software will work for them as well. At Behind the Design, we use Quickbooks.

Tip 2: Automate repetitive financial tasks like invoicing, bill payments, and even tracking of expenses. Many software options can connect directly to your bank account and categorize expenses for you. Automation reduces the risk of human error and frees up your time.

Tip 3: Set a regular schedule, perhaps weekly or monthly, to review your finances. This doesn’t have to be a lengthy process; even a quick overview of your cash flow and upcoming expenses can provide valuable insights and help you avoid surprises.

Tip 4: Understanding where your money is going is crucial for creative businesses. Separate your expenses into categories (e.g., materials, subcontractors, marketing) to see which areas consume most of your budget. This insight can help you make more strategic decisions, such as where you might need to cut back or invest more.

Tip 5: Start a habit of setting aside a portion of every payment you receive for taxes and another portion for savings. This can be a fixed percentage based on past tax rates and your savings goals. By doing this, you'll ensure you're not caught off-guard when tax season rolls around or when you need funds for future investments or emergencies.

By integrating these tips into your business practices, you can take control of your financial health, allowing you to focus more on your creative endeavors and less on financial stressors.

In wrapping up, understanding and managing your financials with clarity and precision stands as a cornerstone of success in the design and architecture fields. While diving into spreadsheets and financial statements might not ignite the same excitement as bringing a design concept to life, it's this behind-the-scenes diligence that fuels your business's growth and ensures its longevity.

By embracing the strategies outlined—from making informed decisions based on your financial health to efficiently managing your bookkeeping—you're not just safeguarding your business; you're setting the stage for sustainable success and the freedom to pursue your creative ambitions without financial worry.

Remember, the goal isn't just to survive in this dynamic industry but to thrive, and that means making your financials work for you, not against you. With these insights and tools at your disposal, you're well-equipped to navigate the financial aspects of your business with confidence, freeing you to focus on what you do best: transforming spaces and lives with your creativity and vision.

10 Tips on Hiring and Managing a Bookkeeper

If you feel overwhelmed by navigating the financial waters of your design or architectural firm, you are not alone. I advice designers and architects to hire for the positions in your firm that you either hate doing or just don’t have the expertise. And bookkeeping is one of those positions that I find critical to most small business owners.

Hiring and managing a bookkeeper effectively is an art in itself, one that blends clear communication, mutual respect, and strategic planning to ensure your business's financial health and compliance. Below, I've compiled ten essential tips to help you find and work harmoniously with a bookkeeper, transforming your financial management from a potential headache into a streamlined, efficient process that supports your business's goals and growth.

- Establish Clear Communication: Set clear expectations for how and when communication will happen. Whether it's through weekly check-ins or monthly financial reports, clarity from the get-go prevents misunderstandings and ensures both parties are aligned.

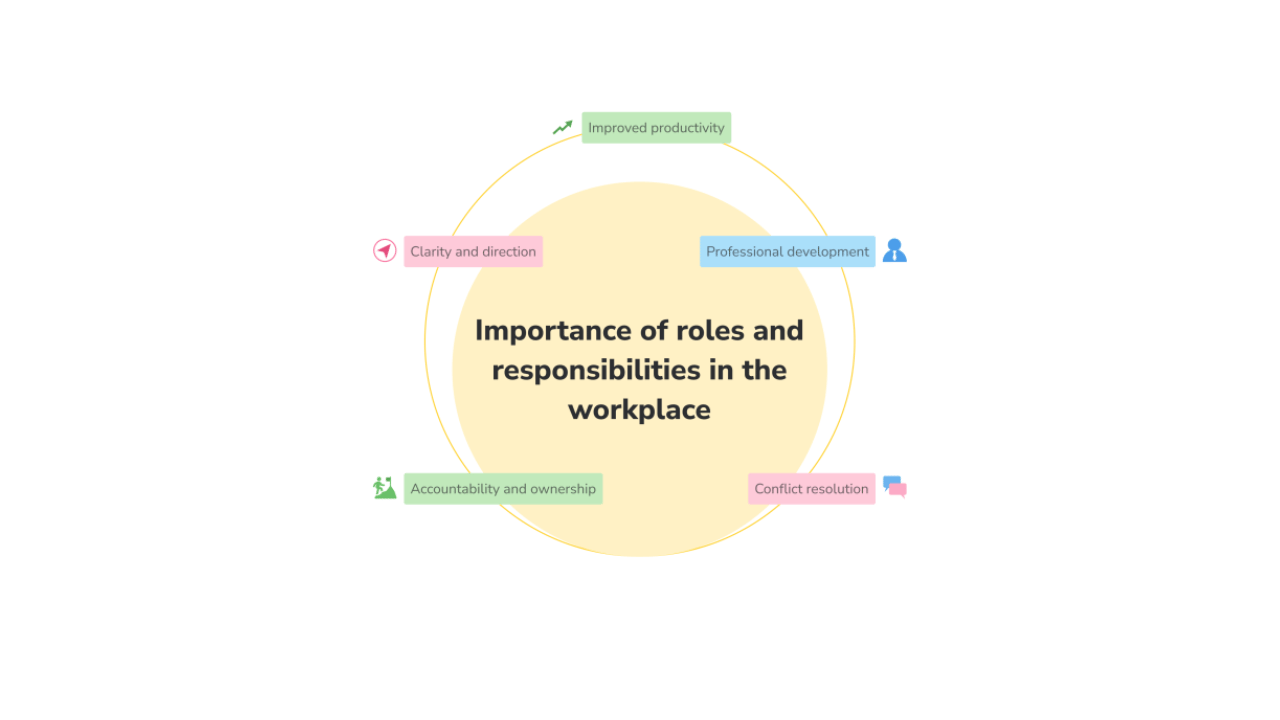

- Define Roles and Responsibilities: Be explicit about what tasks your bookkeeper will handle. This clarity helps prevent any tasks from falling through the cracks and ensures a comprehensive approach to managing your finances.

- Provide Necessary Information Access: Make sure your bookkeeper has access to all needed documents and software. Utilizing secure, cloud-based platforms can facilitate easy and safe document sharing.

- Set Up Regular Reviews: Regular meetings to go over financial reports and address any concerns are crucial. These can be monthly or quarterly and are key to informed decision-making.

- Leverage Their Expertise: Take advantage of your bookkeeper's knowledge for advice on financial processes or tax strategies. A seasoned bookkeeper can offer insights that extend beyond basic bookkeeping.

- Invest in Training: If your business uses specific financial tools or practices, invest in training your bookkeeper to ensure they are fully adept at using them, enhancing efficiency and accuracy.

- Establish Trust, But Verify: Trusting your bookkeeper is essential, as is having a system of checks and balances. Periodic reviews or an annual audit by an external accountant can provide peace of mind.

- Appreciate Their Work: Recognizing the critical role your bookkeeper plays can foster a positive and productive working relationship, benefiting your business's financial health and team morale.

- Adapt Processes as Needed: Be open to adjusting processes and communication as your business evolves. Flexibility can improve workflows and financial management strategies.

- Ensure Compatibility with Your CPA: If you work with a CPA for tax purposes, ensure your bookkeeper's work aligns with their requirements, simplifying tax preparation and financial analysis.

Successfully integrating a bookkeeper into your design or architectural business is a strategic move that can pay dividends in terms of financial clarity, compliance, and efficiency.

Ready to Uncover Your Business's Full Potential?

Say goodbye to the solo grind and uncertainty! Join us at the Hobby to Profitability Masterclass on April 30, 2024 at 10:00AM MDT where we'll equip you with the know-how, tools, and a supportive community to turn your passion into a thriving business. Let's bust those myths and lay the groundwork for your entrepreneurial success, together!

Take our Hobby to Profitability Quiz today! It's your first step in unlocking your business's true potential and figuring out where you're at in your journey. Once you're done, you can hop on board for our next Masterclass session. See you there!

Sign Up for Our Monthly Newsletter

Get helpful career, business, and design tips right in your inbox each month.

At Behind the Design, we are committed to building a stronger design community by reimagining education, training, and support for interior designers. Through our various software training options, educational articles covering everything from leadership to marketing, and soon Continuing educational courses, we are committed to helping you. Join our newsletter to get the latest education and training updates.